WE ARE LEADERS IN TRANSPORTATION SUCCESS!

Occupational Accident Insurance For Truckers & Contractors

Up to One Million Dollars in Coverage for One Low Price

For active full-time independent Truck Owner-Operators or Co-Owners who are contracted with a motor carrier and have not reached the maximum eligible age as stated in the Schedule of Benefits listed with the Policy and on the Enrolment form. In spite of your best efforts to prevent them, accidents can and do happen every day. If a serious accident occurs, your primary concern should be recovering from the injury and not financial loss such an accident can cause you. That's why Health Special Risk designed and Occupational Accident Insurance Program that can provide you and your loved ones with insurance in the event of a covered accident.

Choose between

two plans from the Great American Insurance Company.

PLAN A or

PLAN B

Currently, not available in DC, MA, NV & VT

Covered Activity

Coverage 24 hours a day while under dispatch from a contracted motor carrier.

Accidental Death and Dismemberment

Survivors Benefit

Paralysis Benefit

Severe Burn Benefit

Accidental Medical Expense Coverage

Temporary Total Disability Coverage

Continuous Total Disability

Medical expenses related to accidental injuries

Weekly and on-going disability payments due to injury

PLAN A

Great American Insurance Company

$147

per month / per driver. Owner Operator Plans: age 23-70

✓ Truckers Occupational Accident Insurance pays benefits for injuries sustained in a covered accident

✓ $1M Accident Medical Expense, $0 deductible. Incurral period 2 years

✓ $200K Accident Death And Dismemberment or Paralysis

✓ $50K Survivors Benefit Lump Sum + $1,500 MTH UP TO 100 Months

✓ $200K Coma Benefit, Principal Sum

✓ $125.00 Accident Dental Benefit

✓ $450 per week Temporary Total Disability for 104 weeks 7 day waiting period. (Up to 70%)

✓ $450 per week Continuous Total Disability to age 70 (70% of income up to $450 weekly max)

✓ $10K Hernia Coverage (Life Time Maximum Amount)

✓ $10K Hemorrhoids Coverage (Life Time Maximum Amount)

✓ $10K Severe Burn (Life Time Maximum Amount)

✓ Combined Single Limit $1,000,000

✓ Aggregate per Occurrence $2,000,000

PLAN B

Great American Insurance Company

$126

per month / per driver

✓ Truckers Occupational Accident Insurance pays benefits for injuries sustained in a covered accident

✓ $500K Accident Medical Expense, $0 deductible Incurral period 1 year

✓ $150K Accident Death And Dismemberment or Paralysis

✓ $25K Survivors Benefit Lump Sum + $1000 MTH UP TO 125 Months

✓ $150K Coma Benefit, Principal Sum

✓ $125.00 Accident Dental Benefit

✓ $450 per week Temporary Total Disability for 52 weeks 14 day waiting period. (Up to 70%)

✓ $450 per week Continuous Total Disability Benefit Period to 5 years (70% of income up to $450 weekly max)

✓ $10K Hernia Coverage (Life Time Maximum Amount)

✓ $10K Hemorrhoids Coverage (Life Time Maximum Amount)

✓ $10K Severe Burn (Life Time Maximum Amount)

✓ Combined Single Limit $500,000

✓ Aggregate per Occurrence $1,000,000

Frequently Asked Questions

This is a medical reimbursement group policy. This is NOT Workers’ Compensation Insurance. Each Independent Contractor is required to have his business join the Association thusly upholding his/her independent contractor status. It is mandatory that the Independent Contractor business be a participant in the Master Group. The cost for this is $100.00 per year. Every Independent Contractor can have his/her own policy.

Therefore, you must add $100.00 to whichever plan you choose for the 1st month only. Thereafter, you will only pay the monthly fee (Plan A $147.00 or Plan B $126.00) plus a small administration fee ($5.00).

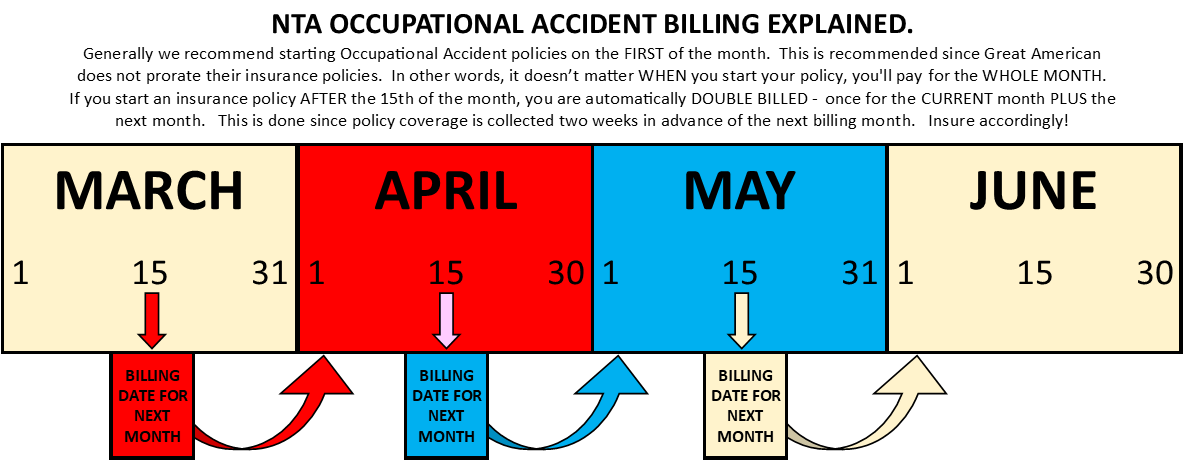

This is a month-to-month policy. Please be advised that you MUST make sure that your Monthly Premium arrives by the 15th day of the month preceding the month for which the premium is being reported. In other words, the premium must be received by NTA Administrative Services two weeks BEFORE the 1st of the month. This allows us plenty of time for processing your policy and forwarding the premiums to the insurance company. Make your check payable to NTA Administrative Services (which is a separate company from NorthAmerican Transportation Association Inc) and remit to: NTA Administrative Services, 9120 Double Diamond Parkway, Ste 346, Reno, NV 89521. Fax: 562-279-0566 and 800-810-6998

To add someone, fill out the application in full and mail in with the applicable fees to NTA Administrative Services, 2201 Willow Avenue, Suite D 224, Signal Hill, CA 90755. Fax: 562-279-0566 and 800-810-6998

We must be notified in writing of any deletions within 72 hours of the person being terminated from the policy. Use the deletion form provided. This is necessary to protect you from any false claims.

To be always on time, we encourage everyone to either pay online, ACH or by credit card. We will debit your account each month. If you pay by credit card, there is a small processing fee of 5%.

CLAIM PROCEDURE FOR OCCUPATIONAL ACCIDENT INSURANCE

Any doctor may treat you. To be reimbursed for your medical expenses, claims must be reported within 20 days after the occurrence or commencement of any loss covered by the Policy, or as soon thereafter as reasonably possible.

The Company, upon notice of a claim may furnish to the claimant additional forms necessary for filing proof of loss.