How Trucking Fleets Can Escape the Insurance Squeeze

Even if a trucking fleet were never to have a crash or injury, it still must be insured – adequately insured, and at the lowest reasonable cost. That is getting tougher to pull off as commercial insurance coverage becomes more costly than ever. However, there are more than a few routes a fleet can take to help escape the squeeze of rising insurance costs.

Helping push premiums sky-high are an array of negative risks that insurance underwriters must carefully weigh. Above all, right now, they’re rightly concerned about so-called “nuclear verdicts” that are astronomical enough to drive trucking companies out of business.

Also impacting insurance cost and availability is the departure from the trucking market of commercial insurance providers that have deemed trucking operations too risky to underwrite. Other cost factors include the ever-shrinking pool of highly qualified drivers and the rising scourge of distracted driving.

Even running newer trucks can be a cost factor. Although they are equipped with more advanced safety equipment to ward off collisions, those that are in a crash will cost more to repair. Still, there’s no denying that technology can reduce crashes. Insurers especially point to the safety advantages of installing video-camera systems, both driver- and road-facing; accessing safety data from electronic logging devices; and spec’ing such advancements as lane-change warning and collision-mitigation systems on new trucks.

And among other risks fleets now face, one that did not even exist until last year is leading to more liability suits and workers’ compensation costs: The novel coronavirus causing the global pandemic of COVID-19 (see box at the end of the article).

In the American Transportation Research Institute’s 2020 survey of the top issues facing trucking, insurance availability and cost ranks fifth, right after the hot-button Compliance, Safety and Accountability enforcement regimen and just before that ever-recurring issue, driver retention.

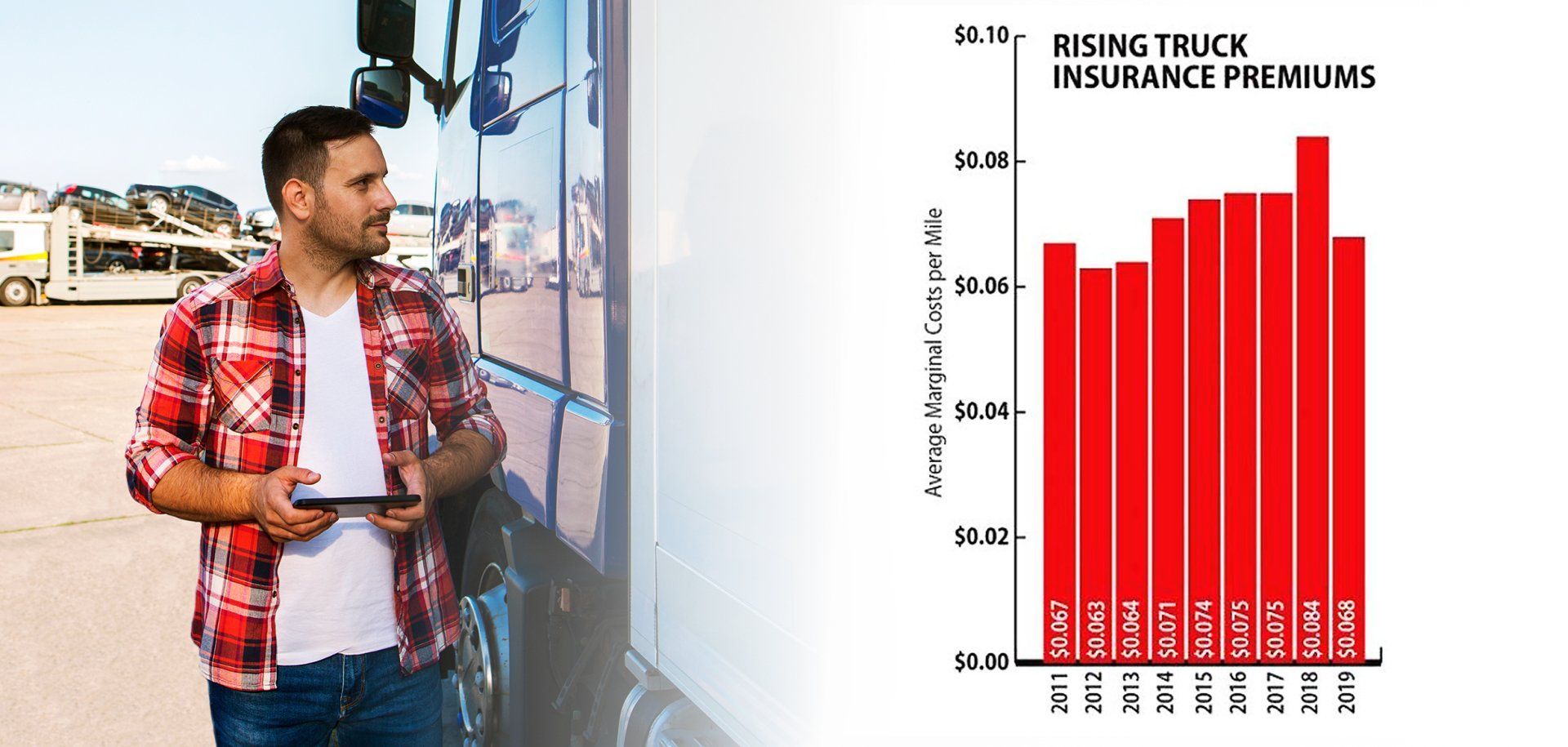

ATRI states in its latest annual Operational Costs of Trucking report, issued in November, that with fleets incurring substantial insurance cost increases over the last several years, the industry may have “reached a ceiling in its ability to continuously cover annual double-digit increases in insurance premiums.”

That cost study shows that truck insurance premiums fell for the first time since 2012, dropping from a historic high of 8.4 cents per mile in 2018 to 6.8 cents per mile in 2019.

ATRI'S Operational Costs of Trucking shows that truck insurance premiums fell for the first time since 2012, dropping from a historic high of 8.4 cents per mile in 2018 to 6.8 cents per mile in 2019.

But that decrease came with a price. Insurance companies report, per ATRI, that “trucking fleets are assuming higher risk levels through higher deductibles, self-insurance, expanding use of insurance captives, and lower levels of excess liability coverage.”

Looking forward, the research group’s outlook on insurance is clear-eyed: “Based on input from insurance industry experts, insurance costs will continue to increase in the near future, although at a somewhat lower rate of growth.”

That somewhat slower rate of increases will likely develop from increased adoption of active safety systems and from positive changes resulting from state-level tort reform.

The latter effort is aimed at dampening the fuse of so-called nuclear verdicts – enormous settlements for plaintiffs in post-accident liability suits. ATRI finds that “the size of truck-involved litigation verdicts is increasing dramatically over time.”

On the plus side, the institute notes that Iowa, Louisiana, and Missouri already have legislated such reforms as limiting the discussion in court of a party’s insurance coverage and limiting putative damages to combat “phantom” awards. Expect more state legislatures to take up tort reform this year.

Judges and juries aside, no one can overstate the impact that the day-to-day operation of a given fleet has on its own insurance costs. That includes everything from poor vehicle maintenance to bad driving that can drive down safety performance and thereby force up insurance premiums.

What’s more, fleets that actively leverage risk-management strategies to prevent accidents in the first place will likely be even more successful at curbing insurance costs.

Of Nuking and Reptiles

“The overwhelming belief among fleets and their insurers/reinsurers today is that the commercial auto insurance market is not working,” says Keith Dunlap, transportation practice leader for Gallagher Bassett, a global risk- and claims-management firm.

“The nexus between high verdicts and insurance premiums cannot be emphasized enough,” he continues. “Over the last few years, the total cost of risk has continued to rise by double digits. Runaway verdicts are no longer rare; they are commonplace in most states, even on incidents that do not necessarily generate a severe injury.”

“Many fleets today simply cannot afford a straight guaranteed-cost program

that effectively transfers all risk to the insurance sector for a reasonable premium.”

– Keith Dunlap, Gallagher Bassett

Dunlap reports that, since 2012, trucking verdicts are up approximately 330% compared to 2007-2012. He sees these verdicts as fueled in part by “state court judges, mostly prior plaintiff lawyers, being elected in many states with their election campaigns primarily funded by the local plaintiff’s bar.” In addition, “Letters of protection are being provided by ‘litigation investors’ to medical providers that guarantee their inflated retail medical costs.” And don’t forget the ever-increasing cost of medical care.

Nick Saeger, Sentry Insurance’s assistant vice president of transportation product, pricing and underwriting, also contends that these supercharged verdicts are not brewing up in a vacuum. “I would start with attorney involvement, in general, as being a key contributor to the costs increasing,” he says. “The frequency with which they’re becoming involved in truck accidents is a problem – but more than that, the techniques that plaintiff attorneys are using to drive up verdicts and settlements is outpacing defense attorneys.”

Saeger describes this approach as applying “the Reptile Theory, in which plaintiff attorneys appeal to the feelings of the jury by arguing about the trucking company — sometimes leaving out the facts of the case entirely. Tactics like those drive up the values of cases, leading to nuclear verdicts.

“We’ve also seen evidence of litigation financing,” he adds. This is where “attorneys have their expenses financed by a third-party investor, which entices them to take cases to trial with an aim towards larger awards. Most times, the jury isn’t even aware that litigation financing exists.”

Safety Matters

Even before a legal reptile might crawl onto the scene, there is much that can be done.

“The best strategy [against rising insurance costs]

is to work toward a developing a ‘culture of prevention.’”

– Paul Calhoun, Hub International

“One of the most important things for motor carriers to do right now is to implement — and follow — a detailed safety program,” says Dan Clements, director of sales-transportation at Sentry Insurance. “Your policies involving hiring, training, drug testing, firing, and more will become the focus in the event of a claim. Proving that your drivers and culture prioritize safety will be very important.”

Expanding on that theme, Saeger points to the driver shortage’s impact. “Underqualified drivers are hired to fill seats, and accidents become more frequent. Relaxed hiring standards — or even failure to follow solid standards — can fuel the use of the Reptile Theory as well.” Also, he says distracted driving is causing more accidents. “That behavior increases the likelihood of a crash, even if a truck driver isn’t at fault.”

Gallagher Bassett’s Dunlap says the type of attorney fleets engage also matters. “Carriers often use defense lawyers that can only be described as ‘generalists’ to defend trucking cases. They are not often familiar with the issues faced today by the trucking sector or how best to defend these cases.”

By contrast, “highly skilled plaintiff lawyers focus today on aggravating factors associated with an accident, allegations of spoliation of evidence, negligent hiring/training/supervision, vehicle maintenance, hours of service violations, poor compliance with ... safety regulations, and poor CSA scoring.” An attorney who doesn’t specialize in trucking may not even know that CSA scores are how the Federal Motor Carrier Safety Administration rates motor carrier safety under its Compliance, Safety, Accountability program.

Capacity Crunch

“Commercial auto insurance was largely very profitable in the early 2000s,” says Sentry’s Saeger. But, due to prices falling for years, “soon enough, the results shifted to unprofitability. That happened just before the developments [in nuclear verdicts and worsening safety performance], which exacerbated and extended what has been a long slump for the industry.”

He says the upshot is tighter capacity stemming from some players exiting the primary market in recent years, most recently a couple of risk-retention groups. “Still, there are insurance companies that can service that layer,” he says. “Capacity in the excess layers, above $1 million, is tightening to a larger degree, though. And when that capacity can be found, increases have been even higher than in the primary layer.”

“The best strategy [against rising insurance costs] is to work toward a developing a ‘culture of prevention,’” says Paul Calhoun, vice president of Hub International, a global insurance brokerage. “That’s means putting safety first, starting with driver hiring practices. Those trucking companies not doing this are being driven into a high-premium segment.”

Calhoun says the insurance marketplace can be viewed as a two-lane highway, plus the breakdown lane on the right.

He says fleets with poor safety performance, bad CSA scores, etc., are stuck in the breakdown lane, where they pay “crazy” premiums for coverage. By contrast, In the left-hand “passing” lane are fleets “moving along to best-in-class” safety practices, so they are presented with the most favorable premiums. It is in this most-favored lane that the capacity of insurance coverage is the tightest.

Then there is the right-hand “travel” lane. “That’s where insurers are looking at fleets that are on their way to the left-hand lane or at least, should no longer be kept out of the middle of the road,” thanks to their improved safety scores.

Best Offense

Calhoun says he “doesn’t know how some fleets stay in business in the face of what they are being charged to be insured.” On the other hand, he sees “the best offense for getting insurance costs in line is to become a well-run company.”

One sure-fire way to demonstrate that a fleet’s safety program is well-managed — to insurance carriers and, if need be, in a court of law — is to “invest in telematics, automatic emergency braking, and collision-avoidance systems,” says Gallagher Bassett’s Dunlap. “These are key to avoiding risk and loss.” Yes, he says, more than 85% of all commercial truck insurance customers today “lack this game-changing technology.”

“Your policies involving hiring, training, drug testing, firing,

and more will become the focus in the event of a claim.”

– Dan Clements, Sentry Insurance

In-cab cameras are also widely cited as a tool that can help prove a company’s commitment to safety, improve its safety record through driver coaching on events captured by the cameras, and often exonerate a driver who was not in the wrong.

A new tech option that could be helpful to better-managed fleets is data-sharing.

“New digital-based programs are like those offered with some personal auto insurance plans,” Hub’s Calhoun explains. “The insurance carrier partners with the truck fleet to share certain safety data, such as what can be pulled from an electronic logging device, that can be used to assist with coaching drivers. There’s a definite trend to focus more on data then say, five years ago. But it’s not a widespread development yet.”

Sentry’s Saeger points out that the traditional guaranteed cost policy, in which the premium does not fluctuate is “the most expensive of the insurance options. But for most trucking companies, which are typically five units or less, it’s the only option. Guaranteed cost provides full coverage with no unexpected costs to cover. Costs are higher, but they’re also defined at policy inception.” He adds that various financing options are available to spread the cost over the duration of the policy.

Noting that “trucking bankruptcies have almost tripled over the last 18 months,” Gallagher Bassett’s Dunlap contends that “many fleets today simply cannot afford a straight guaranteed-cost program that effectively transfers all risk to the insurance sector for a reasonable premium. In fact, a significant number of fleets are now forced to forego excess coverage, struggling with just the premiums on their primary layer of coverage.”

Setting Deductibles

“The upside of assuming a greater amount of the risk through higher deductibles

is lower premiums, but the downside is the potential for financial ruin.”

– Bobby Hanlon, Goldberg Segalla LLP

One way around the expensive premiums of guaranteed-cost options is to opt for a large-deductible program, with deductibles ranging from $100,000 to $5 million depending on the size of the carrier.

With these programs, explains Dunlap, “the carrier’s claims department is likely to manage the losses, thereby making the buyer subject to the strengths or weaknesses of that claims department. Juxtapose a large-deductible plan with a program where an insured takes a large self-insured retention (SIR) under a commercial carrier’s policy.”

He says the latter approach “allows the insured the ability to control the claims process, either internally or through the retention of a qualified claim administrator.” Then the carrier can “truly manage the process by hiring its choice of counsel; implementing its litigation philosophy; controlling its claims data, and learning risk mitigation efforts from its losses.”

Fleets may also look at setting up a captive-insurance plan, which traditionally insure a parent company or affiliates. “Captives afford companies the opportunity to manage their own underwriting risk,” says Dunlap. “Depending on whether the captive formation is wholly owned, a group captive, or a ‘rent-a-captive’ [in which the captive insurance company can be used by unrelated insureds], the initial and ongoing capital outlay will vary. “

He adds that fleets should bear in mind that the resulting “insurance companies” are regulated and have attendant costs, such as legal, actuarial, underwriting, and claims handling. “When done well, a company can earn underwriting profit that can be applied to offset future premiums.”

The Fronting Approach

Fleets, including those setting up a captive insurance plan or seeking to be self-insured, may opt for a “fronting” insurance policy.

Bobby Hanlon, partner and trucking practice co-chair of law firm Goldberg Segalla LLP, explains that “’fronting’ insurance policies allow motor carriers to reduce premium costs and maintain control over their claims while at the same time ensuring compliance with federal and state financial responsibility regulations.”

Under fronting policies, he says, which are sometimes also referred to as “matching deductible” policies, “the trucking company remains responsible for its own defense and losses, and the insurance company acts merely as a surety [a guarantor of the debt.]

“Since the company is responsible for its own losses, the premiums are lower than they otherwise would be for the same policy,” he continues. For example, consider a fleet with a $1 million policy. “If it retains essentially all of the risk with a $1 million deductible,” Hanlon points out, “its premium will be much less than if it retains just 10% of the risk with a $100,00 deductible.”

While a fronting policy may sound like self-insurance, Hanlon is careful to point out that is not, because the insurance company is there to guarantee payment of the loss if the motor carrier becomes insolvent. In defending trucking cases for over 15 years, he says he’s never come across a truly self-insured motor carrier.

Everyone likes lower premiums, but there’s a risk to higher deductibles. He recommends that a fleet determine what level of deductible it can tolerate, “factoring in that deductibles are usually per occurrence, and so the company could potentially be on the hook for more than one.”

That means that even a relatively low deductible of $100,000 per occurrence could put a smaller company out of business if it is involved in multiple crashes. “The upside of assuming a greater amount of the risk through higher deductibles is lower premiums, but the downside is the potential for financial ruin,” says Hanlon. “It’s a balancing act.”

Chris Cavallo, partner and transportation coverage group leader of Goldberg Segalla, says that deductibles may be “per accident, married to a limit but also have an aggregate limit set for the year. So, it could be $100,000 per incident, but with a maximum amount of $500,000 deducted for the year.”

The surety provided by the insuring company on a fronting policy “means the insurer stands behind the motor carrier,” says Cavallo. “It’s not self-insurance, because the insurance company is on the hook [for the rest of the risk]. But the first impact is on the motor carrier. Only if they cannot pay it does the insurance company handle the obligation under the policy.”

Some words of caution: “A trucking company with a higher matching deductible needs to be in contact with their insurance provider [should a crash occur],” Cavallo says. “They cannot let stuff sit around and not get where it’s needed, such as making sure to send the insurer any time-limited demands made by a third-party claimant or their attorney that the motor carrier pay money as a result of bodily injuries or other damages allegedly sustained by the claimant.”

Another road to consider traveling is to set up a risk retention group. These are member-owned liability insurance companies established under the Liability Risk Retention Act that allow businesses with similar insurance needs to pool their risks.

Yet another approach is to set up a risk purchasing group under the Risk Retention Act of 1986. That law allows a group of insureds that are engaged in similar businesses or activities to purchase insurance coverage from a commercial insurer.

Sentry’s Saeger recommends looking to providers with trucking expertise.

“Being an expert [insurer] is important,” he says. “Experts provide the proper coverage and products, have safety professionals to help a motor carrier’s own safety program, and have claims handlers who have handled nothing but trucking claims and know how important it is to get back on the road.”

Size and Mission Matter

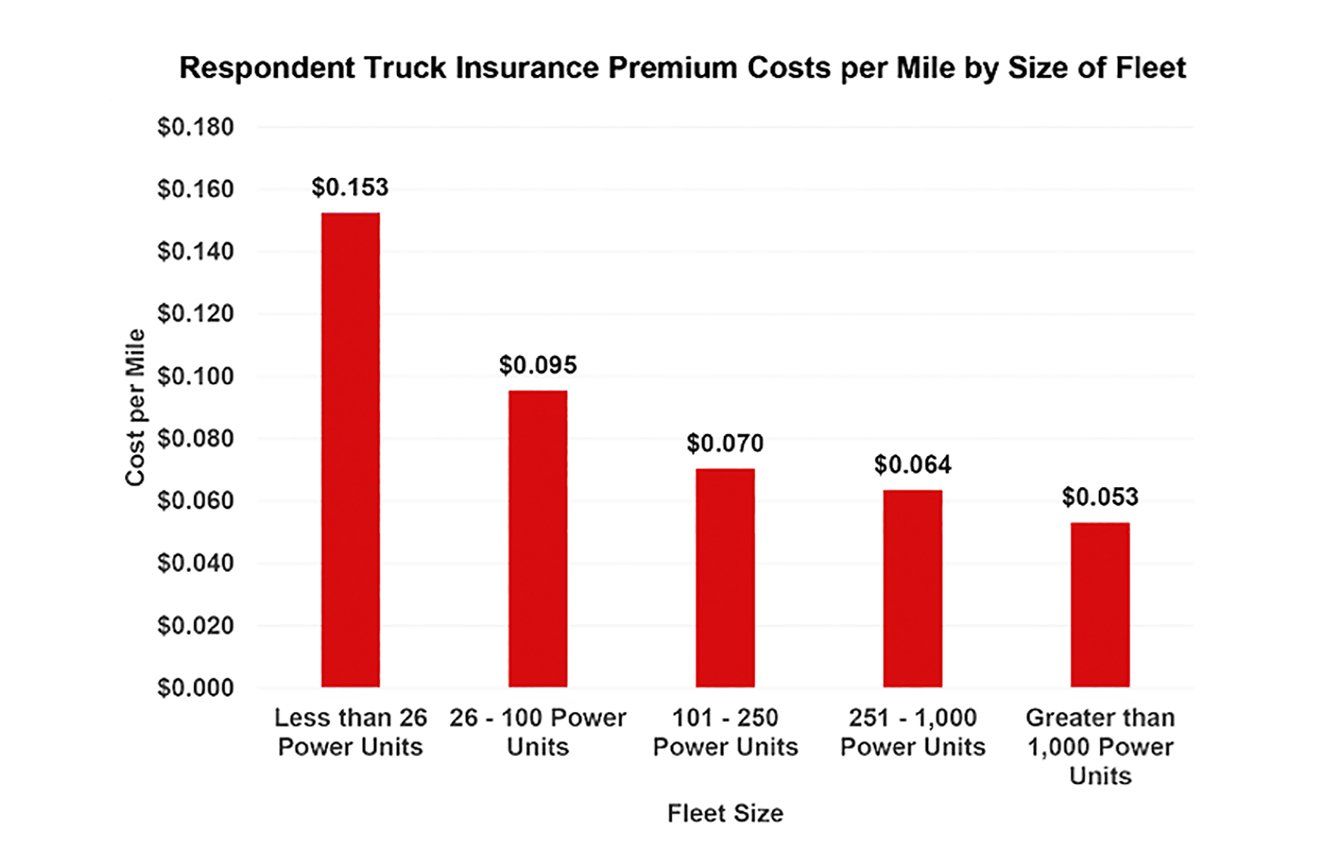

Fleets with fewer than 26 power units reported insurance costs of over 15 cents per mile in 2019, ATRI officials said.

Insurance cost is among the industry top 10 issues, as determined by the American Transportation Research Institute, and it’s one that cuts across all segments of trucking.

Big or small, insurance is going to cost you. But fleet size (see chart) all by itself “plays a substantial role in how insurance costs and risk are managed, according to ATRI in its latest Operational Costs of Trucking report.

“Breaking down the insurance cost per mile by fleet size, it is clear that the smallest fleets, those with fewer than 26 power units, reported insurance costs of over 15 cents per mile in 2019,” says ATRI. “In comparison, fleets with over 1,000 power units reported insurance costs of 5.3 cents per mile.”

Not surprisingly, highly specialized fleets reported the highest insurance cost – 7.5 cents per mile. “These carriers oftentimes haul more dangerous freight, and their insurance costs reflect that,” notes ATRI.

Then there are the private fleets, which have seen their insurance costs and claims decrease every year since 2017. Insurance cost “stabilized” at 9 cents per mile, per 2019 data. “Private fleets, as units of larger, non-trucking companies, have many more tools and strategies for hedging insurance cost increases,” ATRI points out.

Content Disclaimer: Due to the constantly changing nature of government regulations, it is impossible to guarantee the total and absolute accuracy of the material contained herein or presented. NorthAmerican Transportation Association (NTA) cannot and does not assume any responsibility for omissions, errors, misprinting or ambiguity contained. NTA shall not be held liable in any degree for any loss, damage or injury caused by any such omission, error, misprinting or ambiguity present. It is made available with the understanding that NTA is not engaged in rendering legal, accounting or other professional service. If legal advice or other expert service is required, the services of such a professional should be sought.